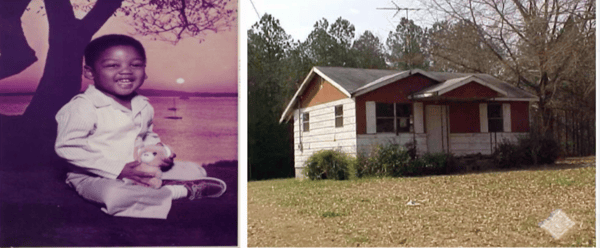

Seth Mitchell's childhood home (Photo/Seth Mitchell)

Seth Mitchell's childhood home (Photo/Seth Mitchell)

Growing up, the only model of success Seth Mitchell had were the drug dealers on his street driving nice cars and wearing fancy clothes. Actually, Seth’s own father was part of the narrative that bad behavior could result in success — until he was caught. That’s when Seth heard a judge say, “You’re a menace to society. You don’t deserve the life in your body,” as the court handed down a two-time life sentence to his father.

But, in the face of adversity, Seth said, “There’s always a lesson and a blessing.”

For Seth, the lesson was that when faced with challenges in life, don’t stop. Instead, push harder. So, Seth made a choice to fight for his life, and rather than repeating the cycle modeled for him, he fought for a better life for himself. He attended Auburn’s engineering program, and he became determined to find an occupation that changed the lives of individuals each and every day.

His blessing was the credit repair business he started and eventually scaled into a million-dollar empire, thanks to his drive to succeed.

Read on to learn how Seth created a credit repair business that was both sustainable and scalable.

What Does it Mean to Scale a Credit Repair Business?

According to Seth’s lecture during the 2019 Credit Repair Expo, scaling is often confused with growing a business, but the two are actually different terms. Scaling a business is about earning more money without incurring more costs. Growing a business, on the other hand, could mean adding more labor and costs to your overhead, without actually increasing your personal revenue.

Though many people want to scale their businesses, they don’t always prepare well enough to make it a reality. To determine how prepared you are, ask yourself:

- What is your goal with regard to scaling your business?

- If your goal is to grow your revenue, what steps have you taken to do so effectively?

- How well do you know your business numbers? Have you identified the areas where you can cut costs?

If you’re unsure how to respond to these questions, keep reading. We’ll help you start to formulate your plan, and find answers.

Develop Your Strategy to Scale

Seth Mitchell at Credit Repair Expo 2019 (Photo/ Nichole Bensel)

Define Your Goal

Though it might sound counterintuitive, scaling your business isn’t measured by growing revenue right away. There are building blocks that must be laid before you can reap the rewards. For example, Seth focuses on fringe services to grow his affiliate network, which eventually lead to increased revenue.

Seth connects with realtors, property managers, and building owners to offer credit services to tenants in apartment buildings. If renters spend an extra $30 on their rent, Seth will provide credit repair services. The end goal is to help renters eventually earn strong enough credit to purchase a house. By growing his affiliate pool, Seth is able to help more people, which inevitably increases his revenue.

Get Your Foundation Right

If you were handed an extra 300 clients today, could you handle it? Scaling a business starts with creating a foundation that won’t crumble. For many credit repair specialists, a strong foundation requires technology to streamline business processes.

According to Seth, his engineering brain depends on software like Credit Repair Cloud to cut business costs. At the 2019 Credit Repair Expo, for example, Seth said Credit Repair Cloud technology gave his business the ability to digitize the dispute process.

By leveraging software that allows him to send digital versions of dispute letters, Seth eliminated the need to lick and stuff envelopes. His previously manual process was both time-consuming and expensive. Seth estimates automation cut his dispute letter cost to $3.17 a client. This cost includes importing credit report data, creating dispute letters, and sending finalized letters to the bureaus.

Don’t Forget Your Value

When automating and scaling your business, you’ll run into trouble if you continually change the cost of your services. Seth challenges anyone in the credit repair business to keep their prices consistent. Don’t discount your prices for friends and family. Know your value, and demand that anyone utilizing your services pays you what you're worth.

Inconsistency in your pricing structure will make it challenging to scale your business. Not only will you get pushback on your prices from clients who expect a reduced rate, but you’ll also make it more difficult to apply automation to your process due to an overly complex pricing structure.

Set Reasonable Expectations

Scaling a business isn’t always possible for credit repair specialists who are just starting out. Be sure you know what is required to scale so you can properly anticipate challenges you might face.

Scaling your business is a process that takes time and might take a little bit of cash flow in the following areas:

- You might hit some bumps along the road, and while you’re working out the kinks, your revenue could dip temporarily.

- You’ll need to spend money to make money. Even if the cost of technology seems a bit high, think of the return you’ll get from it.

- If you’re not a tech-whiz, it’s OK to outsource for extra help as you set up integrations and automation.

These realizations shouldn’t deter anyone from scaling his or her business, but to give a realistic view of what to expect, and what to prepare for. Remember Seth’s advice, “When you face challenges, don’t stop. That’s when you need to push the hardest.” Persistence will pay dividends in the end.

Our Challenge to You

If you have started your credit repair business, focus on what Seth calls the “effort to impact ratio.” Is there one thing in your business you can do, without a ton of time or effort, that will have a high impact on your results? Think of what that means for you, and take action today.

If you’ve not yet started your credit repair business, take this free online training to make your first move toward starting a sustainable and scalable business.