If you’ve just started a credit repair business, you may feel pressure to show your clients results right away. In an industry where there are no guarantees, it’s critical to find low hanging fruit to increase your clients’ satisfaction and strengthen your brand reputation.

During the 2019 Credit Repair Expo, Ari Marcus, an attorney who specializes in consumer advocacy, revealed specific techniques credit repair businesses can use to deliver quick and valuable wins for their clients.

(Above) Ari Marcus, an attorney at Law at Marcus & Zelman LLC, a law firm focused on consumer advocacy. (Photo/Nichole Bensel)

Specifically, Ari reveals that third-party debt collectors routinely violate the Fair Debt Collection Process Act (FDCPA). These violations are not only common, but they can mean the difference between your clients falling farther into financial hardship or earning bonuses to the tune of:

- $1000 per violation

- Payment for the actual damage they’ve incurred

- Debt collector-paid legal fees

Read on to learn how credit repair businesses can easily combat debt collectors and even make them pay!

Step 1: Familiarize Yourself with the Fair Debt Collection Process Act

Anyone starting a credit repair business should take time to read the Fair Debt Collection Process Act (FDCPA). The FDCPA is written to protect consumers from abusive, unfair, or deceptive practices from third-party debt collectors.

Debt collectors must follow the FDCPA exactly, or face penalties (like the $1,000 per violation fee mentioned above). Still, even with fees looming, Ari says, “third-party debt collectors violate the FDCPA all the time.”

As we continue through this article, we’ll describe which sections of the FDCPA can provide the quickest wins for your business.

Pro tip: Just because the FDCPA is a piece of legislation doesn’t mean you should be intimidated by it. The FDCPA is written for the layperson, meaning it’s easy to digest and easy to understand. But if you’re unsure about the legislation, don’t be afraid to partner with a reputable advocacy attorney for help.

Step 2: Read Your Client’s Validation Notices Carefully

The majority of FDCPA violations occur when third-party debt collectors send debt validation letters to your clients. These letters will outline client’s debt; however, some collectors purposely make the language within these letters vague or confusing.

Collectors use this trick to force consumers into paying debts — whether they’re due or not.

Combat the collectors with knowledge. Note that within five days of the initial notification, all debt collectors must do three things:

1. Disclose the amount of debt owed (including a disclaimer): When your client receives a validation letter, the amount owed should be listed in the notice. The debt collector must also add a disclaimer that the total due is subject to change because of interest and other fees. Without a disclaimer, the third-party debt collector may be violating the FDCPA because your client doesn’t have visibility into the actual amount due.

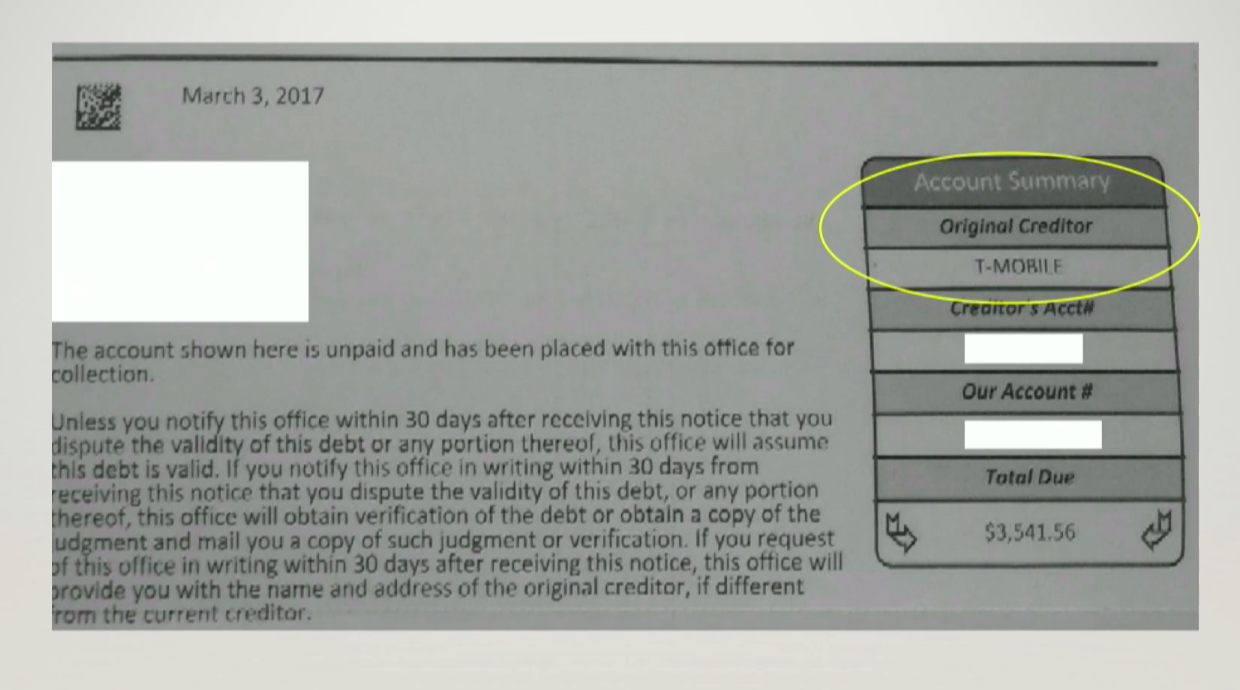

2. Add the name of the creditor to who owns the debt: Often, validation notices will include the original creditor, but won’t specify who currently owns the debt. Many consumers don’t realize this, but without listing the current debt holder in the validation letter, the third-party company is violating the FDCPA.

(Debt validation notice without current creditor name Photo/Ari Marcus at 2019 Credit Repair Expo)

3. Include three sentences in the validation notices: All debt collectors must include the following:

- You have the right to dispute the debts listed on the validation notice

- You have 30 days within receipt of the violation to dispute the debt

- They will provide proof of debt if you dispute the debt

Understanding this requirement is critical for credit repair businesses because debt collectors violate this requirement all the time. For example, if a third-party collector writes “you have 30 days from the letter” as opposed to “you have 30 days from the receipt of the letter”, they are violating the FDCPA. This is because the small adjustment in language narrows your clients’ timeframe for paying back a debt.

The most successful credit heroes go through these notices with a fine-tooth comb and check for violations that provide easy wins for your clients.

Ari Marcus explaining common violations of the FDCPA at the Credit Repair Expo.

Step Three: Identify Other Common Violations of FDCPA

The nuances listed above aren’t the only violations that debt collectors perform. Other more intimidating practices could be affecting your clients, too:

Watch for Overshadowing

Let’s say a third-party debt collector wrote their validation notice correctly. They’ve included the disclaimer for the amount owed, listed the original creditor, and added the correct course of action. It’s case closed, right? Not so fast.

If there is any other language within the letter that diminishes your client’s rights, that’s also a violation.

Ari explains it like this: “if a collector positions a note like ‘you have 30 days from the receipt of the letter to pay the debt, but if you don’t pay in 10 days we will sue you,’ the debt collector has violated the law.”

By threatening to take action sooner than 30 days, the debt collector is overshadowing the law, which is a violation of the FDCPA.

Take Note of How Collectors Communicate

Debt collectors must follow specific rules when communicating with anyone regarding your client’s debt.

For example, a collector must always disclose who they are, especially when contacting friends or family members. Debt collectors are also unable to say that your client owes money to anyone apart from your client.

If either rule is broken, you have a violation on your hands.

Observe When Collectors Contact Your Client

According to the FDCPA, debt collectors cannot communicate with your clients at an inconvenient time or place. This rule is subjective, which means you have the power to inform collectors when they are disrupting you or your clients.

For example, if you tell a collector that you eat dinner with your family between 5-8pm, and it’s an inconvenient time to chat, then they can’t communicate with you during those times. If they still reach out to you during 5-8pm, they are violating the act.

However, Ari warns, “you have to tell them for it to take effect.” A written notice to the collector is the best way to document what you consider inconvenient.

Look for Additional Fees

Finally, a collector cannot tack on additional fees to your client’s debts. It’s common for debt collectors to charge a processing fee for payments, which may seem normal to the layperson, when in fact it is a violation of the FDCPA. Also, look for collectors who offer installment options. Often these arrangements come with extra fees like additional interest or processing fees, which is a violation.

This practice is illegal. If a debt collector tries to charge fees of any type, it’s likely a violation of the FDCPA.

Silence the Collectors Once and for All

Your clients are already under immense financial pressure. The last thing they need is for third-party debt collectors to continue pressing them for money, which will only add to their stress. As a credit repair business, you can take control and silence the collectors once and for all.

Specifically, there are two ways to block communications with debt collectors:

- Write a letter to say stop: Once the debt collector has a written statement that you’d like for them to stop contacting you, they must cease communication

- Refuse to pay in writing: Once you’ve expressed that you will not pay the debt, or that you dispute the debt, third-party debt collectors must stop reaching out to your client

Once you’ve silenced the collectors, any contact moving forward is another violation of the FDCPA. And, without debt collectors on your back, you can start shifting your focus toward other tactics to help repair your client’s credit score.

By understanding the ins and outs of the FDCPA, credit heroes can take the power from the bureaus and third-party debt collectors, and put it back into the hands of consumers. Observing and documenting violations of the act can provide your clients with quick cash rewards.

Are you ready to start protecting your community from illegal debt collection practices? It’s time for you to start a credit repair business. Watch our free online training today!